tax break refund date

The IRS issues more than 9 out of 10 refunds in less than 21 days. Payments are expected to be issued.

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

15 deadline other dates extended to Jan.

. Fastest tax refund with e-file and direct deposit. The IRS issues more than 9 out of 10 refunds in. If you havent received it please contact us at 8043678031.

If you filed after September 5. Its best to avoid contacting the IRS directly unless the Wheres My Refund tool. If you dont receive your refund in 21 days your tax return might need further review.

Starting in May and into summer the IRS will begin to send tax refunds to those who benefited from the 10200 unemployment tax break for claims in 2020. The first refunds were expected to go out in May the IRS said in its March 31 announcement and continue through the summer. For service delay details see Status of Operations.

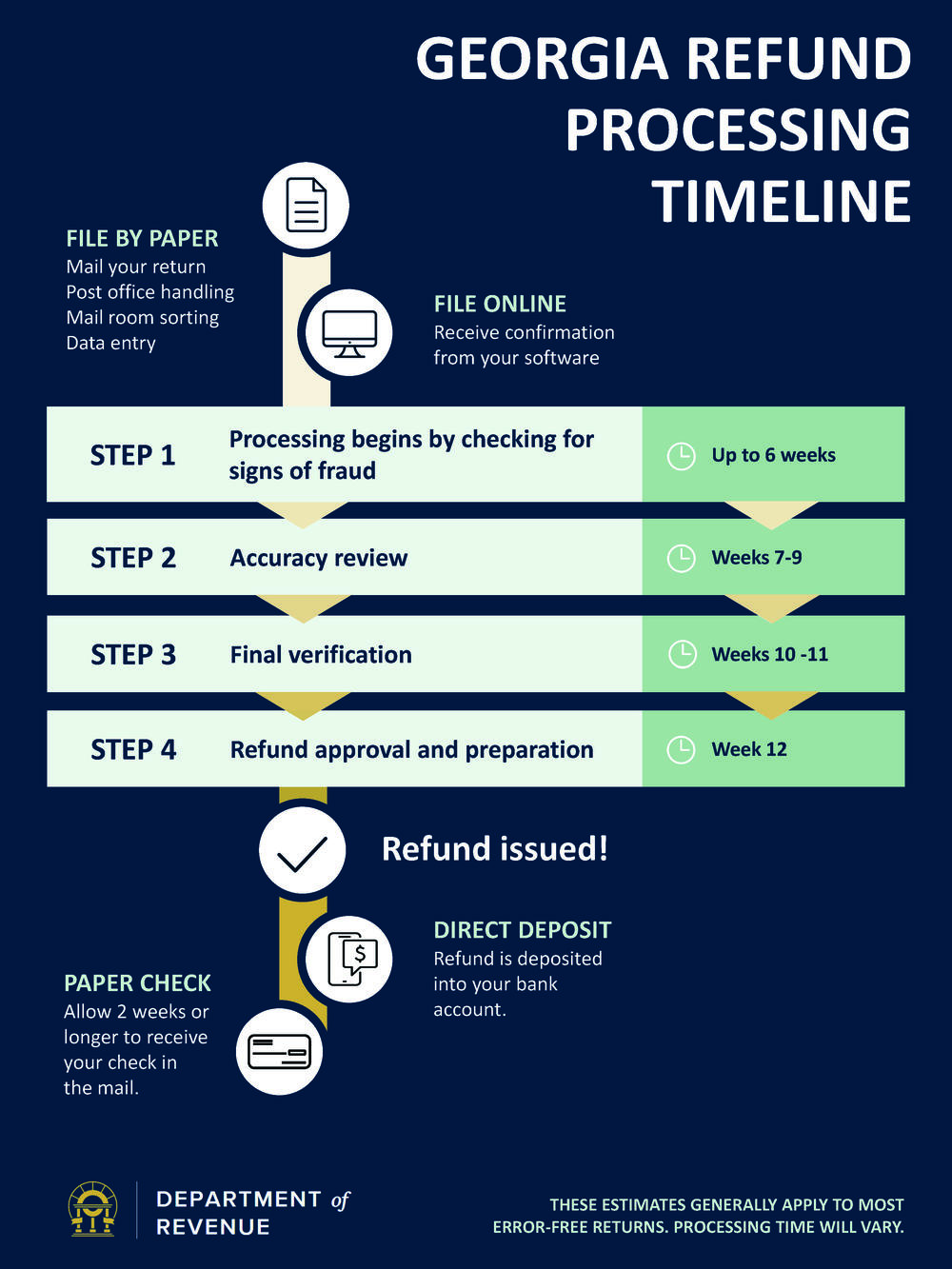

Taxpayers who file paper returns wait longer with refunds generally issued six to eight weeks from the date the IRS receives their return in the mail. The Middle Class Tax Refund MCTR is a one-time payment to provide relief to Californians. Refunds are generally issued within 21 days of when you electronically filed your tax return or 42 days of when you filed paper returns.

A fter more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the. If you file your taxes early you dont have to wait until after the tax deadline to get your tax refund. Depending on the complexity of your tax return you could get your tax refund.

If its been longer find out why your. However if you filed on paper and are expecting a refund it could take six months or more to process your return. If you are eligible you will automatically receive a payment.

Any resulting overpayment of tax will be. Has the most up to date information available about. Tax relief now available to Ida victims in New York and New Jersey.

3 Tax Tip 2021-131 Understanding what. Similarly if you requested an extension filing early means before the. If you filed on paper it may take 6 months or more to process your tax return.

Because the change occurred after some people filed their taxes the IRS will take steps. Since many taxpayers file their returns on the official deadline filing early allows you to beat the rush. Tax refund time frames will vary.

Payments are expected to begin going out sometime in May the agency previously said. Eligible families including families in Puerto Rico who dont owe taxes to the IRS can claim the credit through April 15 2025 by filing a federal tax returneven if they dont normally file and. If youre eligible and filed by September 5 we have already issued your rebate.

This is the fourth round of refunds related to the unemployment compensation. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. Its taking us more than 21 days and up to 90 to 120 days to issue refunds for tax returns with the Recovery Rebate Credit Earned Income Tax Credit and Additional Child Tax.

Its taking us more than 21 days and up to 120 days to issue refunds for tax returns with the Recovery Rebate Credit Earned Income Tax Credit and Additional Child Tax.

The Federal Tax Deadline Is April 18 2022 What You Should Know For Your Refund Life Kit Npr

When The Irs Has Received Your Tax Return Where S My Refund

Tax Refund Schedule 2022 How Long It Takes To Get Your Tax Refund Bankrate

Child Tax Credit 2021 2022 What To Know This Year And How To Claim Your Refund Wsj

What Is Tax Deductible Increase Your Refund With Tax Deductions

Here S Your Estimated 2022 Tax Refund Schedule

Child Tax Credit 2022 When Is The Irs Releasing Refunds With Ctc Marca

Irs Cp 08 Potential Child Tax Credit Refund

2022 Irs Transcript With 846 Refund Issued Code

2022 Tax Refund Schedule When Will I Get My Refund Smartasset

I Did My Taxes On 1 29 I Already Got State Back This Is What Federal Looked Like Is There A Reason It S Taking So Long It Used To Look Different Up Until

Irs Tax Refund Calendar 2023 When To Expect My Tax Refund

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Where Is My Tax Refund This Chart Shows When You Can Expect It

Where S My Refund Virginia Tax

Check My Refund Status Georgia Department Of Revenue

Where Is My Tax Refund This Chart Shows When You Can Expect It

Here S How Long It Will Take To Get Your Tax Refund In 2022 Cbs News